CASE STUDY:Samoa Ministry for Revenue

Upgrade helps Samoa MCR achieve a sustained growth in revenue

The Ministry for Revenue (MfR) decision to invest in DataTorque RMS has reaped rewards for the administration of the Samoan tax system. Dramatic improvements in service levels have enhanced voluntary compliance of Samoan taxpayers. Revenue collected has consistently increased over the years, exceeding forecasts, despite setbacks of the measles epidemic and Covid-19 pandemic.

The background

In late 2010, the Ministry for Revenue, the predecessor of the current Ministry of Customs and Revenue (MCR), embarked on a large-scale institutional reform programme to strengthen the quality of revenue administration. The aim was to grow their sustainable tax base and provide for Government services, while delivering a better service to taxpayers.

Having used RMS and worked successfully with DataTorque since 1997, the call was made to upgrade to DataTorque’s RMS7. With its greater automation, it would deliver the modernisation that was urgently needed to lift efficiency and drive staff productivity that the MfR desired.

The approach

After determining the scope of the project, the DataTorque and MfR project teams defined three phases for implementation, scheduled over four years.

The first phase involved upgrading the core RMS modules to a new technology framework to position the MfR for growth. Phase two introduced compliance case management workflows, automated case selection and commissioned an intranet.

The third phase introduced online services for filing returns, processing payments and viewing statements online. Management dashboards provide real-time information on business performance, enabling the MfR to respond quickly and redirect resources to any areas not achieving their targets. All phases were delivered on time.

Success stories so far

- A record $2.5 billion tala has been collected in the five years prior to 2020, with the bulk of the revenue being taxes owed to the Government.

- The MCR has successfully increased revenue collection and beaten forecasts every year except for 2017/18.

- Improved taxpayer compliance has resulted in MCR achieving revenue targets, despite the adversities of the 2019 measles epidemic border shut down and the Covid-19 pandemic.

- The MCR has transformed from manual, paper-based processes to be fully automated and all taxpayer affairs can be seen in one place.

- Thousands of taxpayers now file their returns online.

- Automated case selection is identifying high-risk taxpayers.

- Obtaining a business licence now takes just five minutes, instead of 3.5 hours - just one example of the dramatic improvements in service levels.

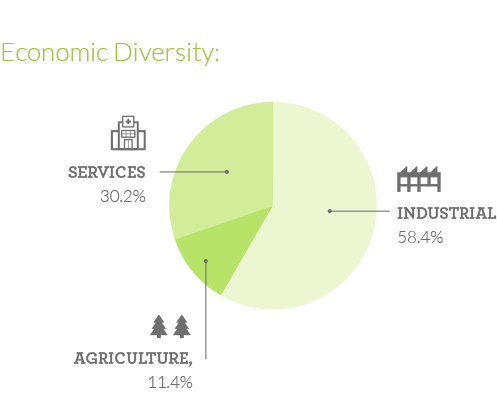

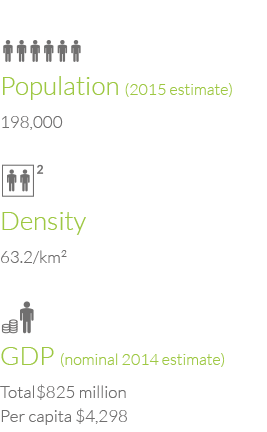

STATS AND FACTS: