Case Studies

We measure our success by how far our clients advance towards the vision they have for their economies. Helping collect revenue is only the start. Helping deliver positive change is the goal.

CASE STUDY:The Bahamas Department of Inland Revenue

The Bahamas use RMS to successfully process new VAT 100% electronically

The Government of The Bahamas chose RMS to minimise the cost of administering their new broad based value added tax (VAT) whilst making it easy for taxpayers to comply. VAT is processed 100% online in a completely paperless environment.

The results have surpassed the International Monetary Fund’s (IMF’s) initial estimates. Due to the success of the tax reforms and their implementation, the Government has generated more than $500 million in VAT revenue each year since it was introduced.

These funds will be used to reduce the Government deficit and advance public infrastructure and services throughout the nation.

The background

Following a competitive international tender, DataTorque was contracted in January 2014 to implement RMS for the Government of The Bahamas to manage the introduction of their new VAT. Historically, The Bahamas had a limited tax regime, and a primary driver of VAT was to broaden the tax base and increase government revenues to position the country for growth.

The approach

Introducing VAT is the centrepiece of the Government’s tax reform agenda and was the first broad-based tax in The Bahamas. Its introduction faced some major challenges. This included establishing a new Central Revenue Administration (CRA) to administer all taxes and implementing a revenue collection framework that was easy to use to encourage voluntary compliance within a new taxpayer community.

RMS went live successfully less than 10 months from contract signing. This meant taxpayers were able to register online before VAT was introduced on 1 January 2015. The RMS solution has now been expanded to manage the other tax types, including Business Licenses.

The solution provides taxpayers with the ability to register, file and pay online (zero paper) and supports taxpayers with online enquiries, training and tutorials.

Success stories so far

- DataTorque successfully delivered all three phases of RMS on time and on budget.

- RMS is in operation at several separate office locations on New Providence and the Family Islands.

- Thousands of tax payers and agents register, file and pay online via RMS customer self-service in a 100% paperless environment.

- The Government generated more than $875 million in VAT revenue in the 2019/2020 financial year.

- The forecast revenue from Business Licence fees in 2020/2021 is over $77 million, rising to more than $100 million in 2021/2022.

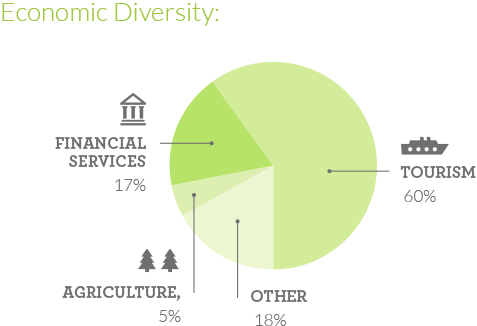

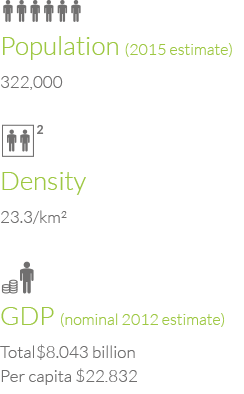

STATS AND FACTS: