CASE STUDY:The Bahamas Department of Inland Revenue

The Government of The Bahamas chose RMS to minimise the cost of administering their new broad based value added tax (VAT) whilst making it easy for taxpayers to comply. VAT is processed 100% online in a completely paperless environment.

The results have surpassed the International Monetary Fund’s (IMF’s) initial estimates. Due to the success of the tax reforms and their implementation, the Government has generated more than $500 million in VAT revenue each year since it was introduced.

These funds will be used to reduce the Government deficit and advance public infrastructure and services throughout the nation.

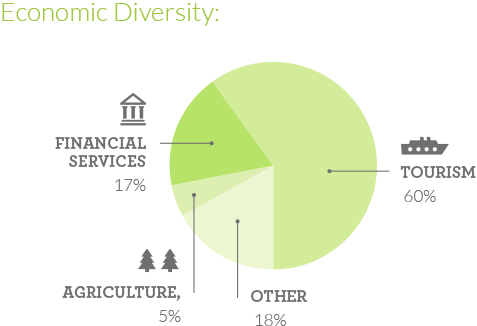

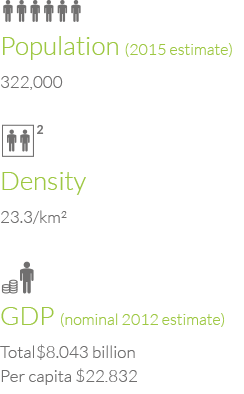

Following a competitive international tender, DataTorque was contracted in January 2014 to implement RMS for the Government of The Bahamas to manage the introduction of their new VAT. Historically, The Bahamas had a limited tax regime, and a primary driver of VAT was to broaden the tax base and increase government revenues to position the country for growth.

Introducing VAT is the centrepiece of the Government’s tax reform agenda and was the first broad-based tax in The Bahamas. Its introduction faced some major challenges. This included establishing a new Central Revenue Administration (CRA) to administer all taxes and implementing a revenue collection framework that was easy to use to encourage voluntary compliance within a new taxpayer community.

RMS went live successfully less than 10 months from contract signing. This meant taxpayers were able to register online before VAT was introduced on 1 January 2015. The RMS solution has now been expanded to manage the other tax types, including Business Licenses.

The solution provides taxpayers with the ability to register, file and pay online (zero paper) and supports taxpayers with online enquiries, training and tutorials.